💰 How much money does Spain owe the world: €1.5 trillion, €2 trillion or €2.5 trillion?

The Bank of Spain clarified for me this morning that Target2 balances at the ECB are not included in the national debt calculations.

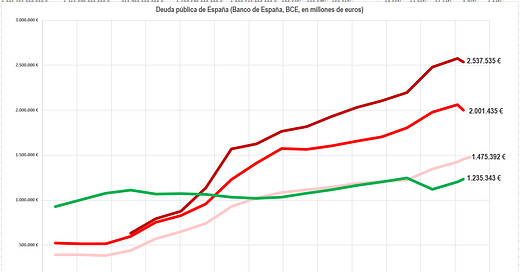

The Bank of Spain announced yesterday that Spain's national debt, according to what Europe calls the "excessive deficit procedure" method, was now €1.475 trillion, rising at an annual clip of 3.6%. GDP last year was about €1.2 trillion. The Spanish government has forecast 2.7% GDP growth for 2023, the IMF has said it will be lower at 2.0%. So the debt is larger and growing faster than the total capacity of the economy. The rise of this way of calculating the debt is the pink line on the graph above, using the numbers provided by the Bank of Spain. This is about 116% of GDP.

There is another way the Bank of Spain calculates the national debt, though, which they publish in their accounts as a column called "current liabilities according to the financial accounts of the Spanish economy". That number is bigger: "it's the broadest possible meausure of debt", explains the Bank of Spain in a note. Instead of €1.475 trillion, this other way of calculating all the money owed to someone is at €2 trillion. The rise of this other Bank of Spain version of the debt is the red line on the graph. This is about 160% of GDP.

Then there is another element that measures how much a country owes or would owe that is rarely mentioned when talking about national debt problems: Target2 balances. Target2 is the European payments system that national banks and central banks within the eurozone use: "Every five days, TARGET2 processes a value close to the entire euro area GDP, which makes it one of the largest payment systems in the world". During the last eurozone crisis ten years ago, there was a lot of debate about whether or not Target2 balances, debt or credit, depending on the country, were real or not or just a very-high level central bank accounting trick that didn't really matter.

Draghi, then still President of the ECB, cleared up that question in 2017 in a letter to two Italian MEPs: "If a country were to leave the Eurosystem, its national central bank's claims on or liabilities to the ECB would need to be settled in full". In full, all of it. If we read the international business press in 2022, most of the headlines about the dangers of Target2 liabilities are about Italy because Italy is the country that currently owes the most there: €627 billion.

Which country has the second largest pile of Target2 liabilities at the ECB? You guessed it: Spain, which currently owes €516 billion, or about half of GDP.

I spoke to the Bank of Spain this morning and they clarified that the Target2 liabilities at the ECB are not included in either of the two versions of the national debt calculation that they publish regularly. The central bank is not considered part of the public administration in terms of calculating debt, either with the excessive debt procedure method or with the current liabilities method.

But Draghi said in 2017 that the liability is real. So if we add the Target2 number to the Bank of Spain's "current liabilities" debt number, we get a third version of how much Spain really owes or would owe someone. That third total is somewhere around €2.5 trillion, which is just north of 200% of GDP. The dark red line on the graph.

💰 Subscribe now:

🔥 Understand the stories changing Spain better

📝 Access all the articles & 💬 Substack chat with Matthew

💪 Guarantee this independent reporting & analysis